II. Very Short Answer Questions

Answer: "Source documents are the authentic evidences

of financial transactions. These documents show the nature of transaction, the

date, the amount and the parties involved. Source documents include cash

receipt, invoice, debit note, credit note, pay — in — slip, salary bills, wage

bills, cheque record slips, etc.

Answer: The word journal has been derived from the French

word 'Jour which means day. So, journal means daily. Journalising is the

beginning of the accounting process for the financial transactions.

Answer: All accounts relating to tangible and intangible

properties and possessions are called real accounts.

Answer: Personal account: Account relating to persons is

called personal account. The personal account may be natural, artificial or

representative personal account

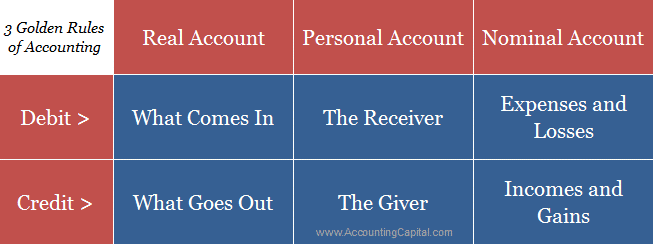

Answer: Debit all expenses and losses credit all incomes and

gains.

Answer:

III. Short Answer Questions

Question 2. What is an Account? Classify the accounts with

suitable examples.

Answer:

1. Asset account: Any physical thing or right owned that has

a monetary value is called asset. The assets are grouped and shown separately;

for example, Land and Buildings account, Plant and Machinery account.

2. Liability account: Financial obligations of the

enterprise towards outsiders are shown under separate heads as liabilities; for

example, creditors account, expenses outstanding account

3. Capital account financial obligations of a business

enterprise towards its owners are grouped under this category; for example,

capital contributed by owner.

4. Revenue account: Accounts relating to revenues of an

enterprise are grouped under this category, for example: revenues from sale of

goods, rent received.

5. Expense account: Expenses incurred and losses suffered

for earning revenue are grouped under this category; for example, purchase of

goods, salaries paid.

Answer: Under double entry system of book keeping, for the

purpose of recording the various financial transactions, the accounts are

classified as personal accounts and impersonal accounts.

1. Natural person's account: Natural person means human

beings. Example: Vinoth account, Malini account.

2. Artificial person's account artificial person refers to

the persons other than human beings recognised by law as persons. They include

business concerns, charitable institutions, etc. Example: BHEL account, Bank

account

3. Representative personal accounts: These are the accounts

which represent persons natural or artificial or a group of persons. Example:

Outstanding salaries account, prepaid rent account. When expenses are

outstanding, it is payable to a person. Hence, it represents a person.

Question 5. State the principles of double entry system of

bookkeeping.

Answer: Following are the principles of double entry system:

1. In every business transaction, there are two aspects.

2. The two aspects involved are the benefit or value receiving aspect and benefit or value giving aspect. 3. These two aspects involve minimum two accounts; at least one debit and at least one credit

4. For every debit, there is a corresponding and equivalent credit. If one account is debited the other account must be credited.

Answer: The following steps are followed in journalising:

1. Analyse the transactions and identify the accounts (based

on aspects) which are involved in the transaction.

2. Classify the above accounts under Personal account, Real

account or Nominal account 3. Apply the rules of debit and credit for the above

two accounts.

4. Find which account is to be debited and which account is

to be credited by the application of rules of double entry system.

5. Record the date of transaction in the date column.

6. Enter the name of the account to be debited in the

particulars column very close to the left hand side of the particulars column

followed by the abbreviation tr.' at the end in the same line. Against this,

the amount to be debited is entered in the debit amount column in the same

line.

7. Write the name of the account to be credited in the second line starting with the word To' prefixed a few spaces away from the margin in the particulars column. Against this, the amount to be credited is entered in the credit amount column in the same line. & Write the narration within brackets in the next line in the particulars column.

Question 7. What is double entry system? State its advantages.

Answer: Double entry system of book keeping is a scientific

and complete system of recording the financial transactions of an organisation.

According to this system, every transaction has a twofold effect. That is,

there are two aspects involved, namely, receiving aspect and giving aspect. It

is denoted by debit (Dr.) and credit (Cr.). The basic principle of double entry

system is that for every debit there must be an equivalent and corresponding

credit. Debit denotes an increase in assets or expenses or a decrease in

liabilities, income or capital. Credit denotes an increase in liabilities,

income or capital or a decrease in assets or expenses.

6.

Create an accounting equation on the basis of the following transactions:

(i)

Started business with cash ` 80,000 and goods ` 75,000

(ii)

Sold goods to Shanmugam on credit for ` 50,000

(iii)

Received cash from Shanmugam in full settlement ` 49,000

(iv)

Salary outstanding ` 3,000

(v)

Goods costing ` 1,000 given as charity

(vi)

Insurance premium paid ` 3000

(vii)

Out of insurance premium paid, prepaid is ` 500

7.

Enter the following transactions in the journal of Manohar who is dealing in

textiles:

2018

March

`

1

Manohar started business with cash 60,000

2

Purchased furniture for cash 10,000

3

Bought goods for cash 25,000

6

Bought goods from Kamalesh on credit 15,000

8

Sold goods for cash 28,000

10

Sold goods to Hari on credit 10,000

14

Paid Kamalesh 12,000

18

Paid rent 500

25

Received from Hari 8,000

28

Withdrew cash for personal use 4,000

8.

Pass journal entries in the books of Sasi Kumar who is dealing in automobiles.

2017

Oct `

1

Commenced business with goods 40,000

3

Cash introduced in the business 60,000

4

Purchased goods from Arul on credit 70,000

6

Returned goods to Arul 10,000

10

Paid cash to Arul on account 60,000

15

Sold goods to Chandar on credit 30,000

18

Chandar returned goods worth 6,000

20 Received cash from Chandar in full

settlement 23,000

25 Paid salaries through ECS 2,000

30 Sasi Kumar took for personal use goods worth 10,000

9.

Journalise the following transactions in the books of Ramesh who is dealing in

computers:

2018

March

1

Ramesh started business with cash ` 3,00,000, Goods ` 80,000 and Furniture

`

27,000.

2

Money deposited into bank ` 2,00,000

3

Bought furniture from M/s Jayalakshmi Furniture for ` 28,000 on credit.

4

Purchased goods from Asohan for ` 5,000 by paying through debit card.

5

Purchased goods from Guna and paid through net banking for cash ` 10,000

6

Purchased goods from Kannan and paid through credit card ` 20,000

7

Purchased goods from Shyam on credit for ` 50,000

8

Bill drawn by Shyam was accepted for ` 50,000

9

Paid half the amount owed to M/s Jayalakshmi Furniture by cheque

10 Shyam’s bill was paid

CONTINUATION: QUESTION: 09

10.

Raja has a hotel. The following transactions took place in his business.

Journalise them.

Jan.

`

1

Started business with cash 3,00,000

2

Purchased goods from Rajiv on credit 1,00,000

3

Cash deposited with the bank 2,00,000

20

Borrowed loan from bank 1,00,000

22

Withdrew from bank for personal use 800

23

Amount paid to Rajiv in full settlement through NEFT 99,000

25

Paid club bill of the proprietor by cheque 200

26

Paid electricity bill of the proprietor’s house through debit card 2,000

31

Lunch provided at free of cost to a charity 1,000

11.

From the following transactions of Shyam, a stationery dealer, pass journal

entries for the

month

of August 2017.

Aug.

1

Commenced business with cash ` 4,00,000, Goods ` 5,00,000

2

Sold goods to A and money received through RTGS ` 2,50,000

3

Goods sold to Z on credit for ` 20,000

5

Bill drawn on Z and accepted by him ` 20,000

8

Bill received from Z is discounted with the bank for ` 19,000

10

Goods sold to M on credit ` 12,000

12

Goods distributed as free samples for ` 2,000

16

Goods taken for office use ` 5,000

17 M

became insolvent and only 0.80 per rupee is received in final settlement

20

Bill of Z discounted with the bank is dishonoured

12.

Mary is a rice dealer having business for more than 5 years. Pass journal

entries in her

books

for the period of March, 2018.

March

`

1

Ricebags bought on credit from Sibi 20,000

2

Electricity charges paid through net banking 500

3

Returned goods bought from Sibi 5,000

4

Ricebags taken for personal use 1,000

5

Advertisement expenses paid 2,000

6

Goods sold to Mano 20,000

7

Goods returned by Mano 5,000

8

Payment received from Mano through NEFT

﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎﹎

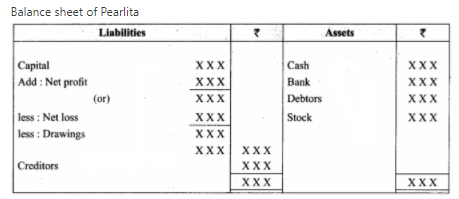

Textbook Case Study

Pearlita is a trader. She buys and sells electronic goods. She maintains double entry book —keeping. She purchases and sells goods both on cash and credit bases. If the purchased goods are not in good condition, she sends them back to her supplier. At the same time, she also accepts if her customers return the goods sold to them, when the goods are not in good condition. She maintains a bank account for her business. She receives and pays money through bank transactions.

Question 1. Why does she maintain double entry book keeping?

Answer: In this system the two aspects of each transaction are recorded in the books of account. This helps in checking the accuracy in accounting.

Question 2. Do all the business units engage in credit transaction?

Answer: No, she purchases and sells goods both on cash and credit basis.

Question 3. Can you think of some business units that have only cash transactions?

Answer: Yes, she has to spend money for expenses and capital also. Nominal accounts also maintained.

Question 4. Is it necessary for Pearlita to maintain a separate bank account for business?

Answer: Yes, she should maintain a bank account for her business.

Question 5. What will happen if she uses her personal bank account for her business transactions? Answer: Because she maintains double entry book keeping, here the owner and the business are separated.

Question 6. Identify the business documents invoked in this case study. Answer: Debit note, credit note, Pay — in — slip, cash receipts, Invoice, cheques and vouchers.

Question 7. Can you think of some assets and liabilities for Pearlita's business?

Answer:

YouTube Channel

Link: https://www.youtube.com/channel/UCGsICV9zGbeZH2akfiLhZDw

11th

TN STATEBOARD BOOK BACK ANSWERS WEBSITE LINK

1. ACCOUNTANCY

- UNIT 1 – https://padvikshablog.blogspot.com/2020/08/tn-state-board-11th-accountancy-unit-1.html

- UNIT 2 –

https://padvikshablog.blogspot.com/2020/08/tn-stateboard-11th-accountancy-2nd-unit.html

2. COMMERCE

UNIT 1

CHAPTER 1

LINK: https://padvikshablog.blogspot.com/2020/08/commerce-11th-unit-1-book-bank-answers.html

CHAPTER 2

LINK: https://padvikshablog.blogspot.com/2020/08/tn-state-board-11th-commerce-unit-1.html

3.

ECONOMICS

UNIT 1

LINK: https://padvikshablog.blogspot.com/2020/08/tn-state-board-11th-economics.html